| SHOP NOW

| SHOP NOWTurning 65 is a milestone moment for a handful of reasons, no doubt. You might be nearing retirement, for one. Plus, you're now eligible for Medicare. And if you have a Health Savings Account (HSA) and have been enjoying all the perks that come with one — triple tax advantages, paying for out-of-pocket medical costs with HSA funds, or using one to stashing money into as a savings account.

If you're wondering how being eligible for Medicare can impact your HSA? It can feel overwhelming for sure, but we can walk you through how you can best manage your HSA and put it to use once you can swoop in on Medicare benefits.

Medicare eligibility when you're 65

There are two parts of the original Medicare — Medicare Part A and Medicare Part B. Medicare Part A covers hospital visits and hospice care. Medicare Part B covers doctor's visits, laboratory, and X-rays. There's also Part C and Part D, which is additional, optional insurance.

When you turn 65, if you or your spouse have worked and paid Medicare taxes you're eligible for Medicare without having to pay premiums. If you didn't pay Medicare taxes while working, when you hit the magic number — age 65 — you can swoop in on Medicare by paying a premium. While the majority of folks age 65 and over don't need to pay a premium for Medicare, everyone does need to pay for Medicare Part B.

HSA contributions when you're on Medicare

Here's the kicker: When you're enrolled in Medicare, you won't be able to make HSA contributions. That's because in order to contribute to an HSA, you need to be on a High-Deductible Health Plan (HDHP) (IRS). Once you're enrolled in Medicare, that nullifies your eligibility. That being said, you can still tap into some of the benefits of having an HSA, and your past efforts in contributing to your account won't go to waste. While you can't make contributions to your HSA when you're on Medicare, you can pull money from it to pay for medical expenses.

Find the gaps in Medicare that your HSA can cover

The money you've so diligently socked away into your HSA? That money is still yours to use tax-free on any out-of-pocket medical expenses, such as:

- Medicare premiums

- Deductibles for Medicare

- Co-pays

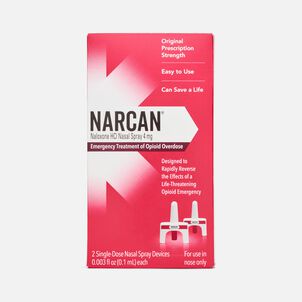

- Over-the-counter medications

- Dental care

- Vision care

- Telehealth

- Eligible items for your medicine cabinet and home use

- Eligible expenses, such as your hearing aids, inhalers, and prescription glasses

Review Medicare coverage

Before you receive your Medicare benefits, do your homework to find out exactly what is covered under Part A and Part B — and what's not covered. Next, look at how much you'll be paying for premiums, deductibles, co-pays, dental care, and so forth.

As your medical expenses might seem a bit trickier now that you have Medicare benefits, consider creating a spending plan just for your healthcare costs. Next, see where your HSA funds can help cover some of the costs.

It might be useful to start with the big-ticket, predictable, and recurring expenses — such as premiums and deductibles. You might also want to include routine visits to the eye doctor, dental checkups and cleanings, and X-rays.

Next, jot down out-of-pocket eligible medical expenses that you'll be able to pay for using your HSA funds — over-the-counter medications, and any medical equipment, supplies, or prescription medication for a chronic condition. For instance, if you have asthma, an inhaler. If you're diabetic, insulin, and so forth. That's money you'll be spending tax-free.

While it's hard to predict out-of-pocket expenses for accidents and illnesses, consider setting aside a set amount for unexpected healthcare costs. Should something come up, that money you set aside in your HSA could really come in handy.

Making contributions once you're enrolled in Medicare

Let's say you keep making contributions to your HSA after you're enrolled in Medicare. Should this happen, you might get dinged with a penalty. How much are we talking about here? The IRS looks at contributions you make to an HSA as "excess contributions."

As these contributions are categorized as such, you're subject to paying back taxes, and a 10% withdrawal penalty during the "testing period." When you do take money out of your contributions, you'll also be on the hook for paying another 6% on your withdrawals (Healthline).

A testing period comes into play when you're on an HDHP and eligible to make contributions to an HSA for part of a calendar year. If you contribute the full amount that year, you'll need to be on an HDHP for the entire following year to enjoy those contributions tax-free. Otherwise you'll need to pay taxes and a penalty.

If you start receiving Medicare benefits, say, mid-year, you can only contribute part of the annual contribution limit. Otherwise, you'll be hit with paying back taxes, excess taxes, and taxes during the testing period.

Working past 65

If you're planning on working past 65, there is a way for you to still make contributions to your HSA - if you plan on postponing receiving Medicare and Social Security benefits while you're working. Does your employer have 20 or more hires? If so, and you haven't filled out an application for these benefits, you don't need to do anything else.

If you're already submitted an application to receive Medicare, you can withdraw your application so you don't receive benefits. As long as your benefits don't kick in, and you're on an HDHP, you can continue putting money into your HSA.

Figuring out the delicate dance between your HSA and Medicare can be tricky. But by doing your homework and exploring different scenarios, you can manage your HSA when you start receiving Medicare benefits. In turn, it can help your financial picture when you hit that 65 milestone.

—

Thank you for visiting the HSA Store Learning Center™. Don’t forget to follow us for more helpful tips on Facebook, Instagram, and X (formerly twitter).